Healthcare models, centralization and decentralization approaches in focus

In those states where governments play a leading role in healthcare, a certain decentralization of government functions and delegation of certain responsibilities to the regional and municipal authorities is observed. In this case the private sector largely concentrates on specialized and auxiliary functions and services. In countries where the government plays a less significant role in healthcare, on the contrary, the strengthening of centrally of cetnralization mechanisms takes place. This is where the importance of government regulation, as well as the fact that it must be extremely dotted and professional, becomes obvious. Decentralization is considered to be an effective way to improve the service of the public to determine priorities and to reduce disparities in state of health of general population.

Excessive decentralization leads to fragmentation of services, weakening of central government bodies, irrational and less professional use of equipment and medicines, the inequality in the consumption of healthcare services and political manipulation in favor of the interest groups in the regions.

European healthcare systems are mostly decentralized and are funded from three financing sources: state grants, earmarked contributions and employers’ contributions paid by employees. The ratio of these sources varies from country to country.

So this is how they do it in the US

Medical insurance in the US is very different from the one used in Europe. The US Constitution does not provide public health care funding for all citizens, except for socially disadvantaged groups. A unified national health insurance system didn’t exist until the introduction of Obamacare, but at the same time until recently healthcare expenses were higher than the ones in Europe by 1.5 – 2 times higher. Furthermore, spending healthcare expenses grow rapidly in the country (from $247.2bn. in 1987 to $1.04tr. in 1995 and up to $2.3tr. in 2013); importantly, 75% of employees are insured employers in the private insurance companies. Until recently the insurance programs provided coverage to the elderly, the disabled and the poor (we are considering the periods before Obamacare was carried out into effect). Almost 3 quarters of US population hold private insurance. As for the state insurance, approximately 27% of the population holded the package and 13% of them had ‘Medicare’.

The majority of Americans work with private insurance companies and stick to one of the schemes: pay per service or a regulated scheme of medical services. The first one implies up to 80% reimbursement of expenditures and covering 20% of expenses out of pocket. The second option is largely based on preventive approaches, emphasizing the importance of timely treatment and keeping fit. In the second scheme, unlike the first, reimbursed expenses related to professional examinations and treatment aimed at alcoholism and drug addiction elimination. The second scheme is slowly regaining control, and not the least important factor is its accessibility (way cheaper in comparison with reimbursement plan). The introduction of co-payments has become a standard in the US, because it is believed that as long as patients do not begin to pay at least some money for the services they receive, they consider these services not highly important.

Canada: public health paradise?

Canadian health insurance system is dominated by health savings accounts, aiming at a reduction costs for employers and employees by an average of 20%. Savings accounts are derived from contributions of employers and belong to the employee, while the unspent funds are accumulated on a person’s account. Workers tend to invest these funds in more expensive services in the process of time. This allows, on the one hand, the possibility of funds capitalization in the market of medical services; on the other, the system immediately attracts the attention of consumers of health services, giving the desired confidence that these charges are their property. However, this system has a major flaw: if a patient needs a very expensive treatment, covering the costs with savings account is typically impossible due to insufficiency of funds. At the same time, the state carries out additional insurance payments ranging from full to partial coverages, depending on certain factors (age, condition, residence, etc.). This model of insurance is considered to be more economical, as the patient is interested in staying healthy which eliminates unnecessary costs. Canada spends on healthcare approximately 9.5% of GDP, with an average of $2,500 per person. The survey revealed that most Canadians (72%) consider the idea of using health savings accounts to be reasonable, as well as the choice of services basing on the needs (67%), and as a means to increase the responsibility of health professionals (55%).

The Japanese way

In the recent years Japan has made undeniable progress in improving the health of the population. Insurance medicine has started gaining momentum since 1972 and later on it has acquired an national status. It is built on the territorial principle and covers various social groups: the disabled, unemployed, etc.. The services provided to this cohort of patients are 70-90% covered by the state, not including pharmaceuticals, private nursing services, or private room in hospitals these types of services are paid out-of-pocket. The costs of treatment are thoroughly controlled by consultants, social security authorities and the Ministry of Health. Businesses, government and the insured get the funds through the three streams of insurance. Temporary disability benefits are paid from the 4th day of illness in the amount of 60% of earnings. On average, Japan spends 6.6% of GDP on healthcare, with an emphasis on disease prevention.

The triple alliance in action

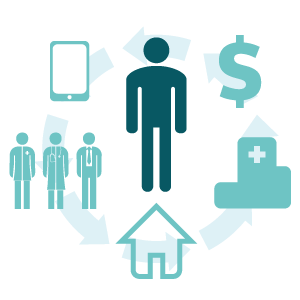

The system of ‘patient hospital insurance fund’ created an economic symbiosis, where all the participants find themselves in a win-win position. The opposers of the current system point on regular scandals in the United States related to the huge bills of the hospitals for their services, often emphasizing the facts of patients left alone against the commercial medicine machine. In these circumstances, the system begins to unwind the spring of unrestrained price growth, moreover, are imposed on such medical procedures in the conduct of which it is not necessary.

Medical services, as opposed to, let’s say, hairdressing or beauty services, are characterized by an absolute lack of alternatives and the need for rapid decision-making. In some cases heart surgery simply cannot be replaced by appendectomy. The patient is oftentimes unable to select the medical facility or from a variety of price offers, especially in emergency situations that threaten life. In such a situation the insurance fund (the company) enters the stage as a regulator of the physician-patient relationship. The insurance fund is interested in providing:

- medical care at the lowest cost as the insurance premium has been received already in the amount sufficient for treatment of a patient and the profit of the insurer;

- quality care, otherwise relapse will require new, oftentimes even higher costs;

- timely preventive measures, as they are less costly as compared to the treatment of chronic diseases.

These principles provide a higher quality of care at reasonable financial costs. There is another side extremely important to the well-coordinated work of the aforementioned triumvirate employers. Of course, they are interested in keeping their staff healthy, at least to exclude the possible financial losses. Recently, the most advanced employers switch to Western standards, hoping that social security services can keep employees in the company, increasing dedication and reliability, which is even more effective loyalty instrument than an addition to wages. Moreover, the insurance contributions are the expenses subjected to taxation. In either event, an insurance fund is a vital intermediary that saves 20-30% of potential expenses through rational use of funds, leaving in its own fund from 1 to 5% with the proper control of money flows.

Research by Canadian Health&Care Pharmacy service: www.canadianhealthmall.com